Forex trading scams are an unfortunate reality in today’s digital financial landscape. With the rise of online trading platforms, scammers have found new avenues to exploit unaware traders. Whether you are a new trader eager to dive into the world of forex or an experienced trader looking to optimize your investments, it’s crucial to be aware of potential scams that can jeopardize your finances. In this article, we will explore common types of forex trading scams, how to identify them, and what measures you can take to protect yourself, including the importance of choosing reliable forex trading scams Turkish Trading Platforms and other trustworthy resources.

What is Forex Trading?

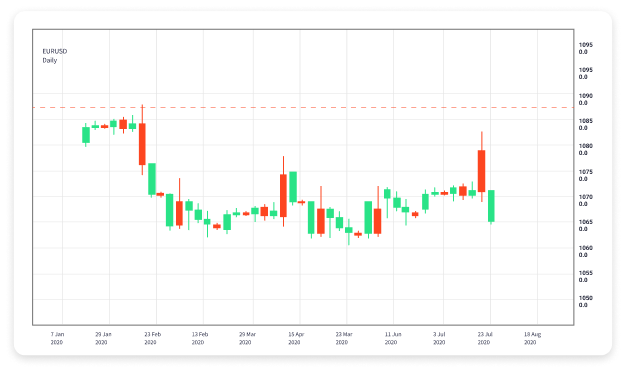

Forex, or foreign exchange, is the global marketplace for buying and selling currencies. Traders engage in forex to speculate on the price movements of currency pairs, aiming to profit from fluctuations in exchange rates. The forex market is the largest and most liquid financial market in the world, operating 24 hours a day, five days a week. This environment presents numerous opportunities but also attracts dishonest individuals seeking to take advantage of less-informed traders.

Common Types of Forex Trading Scams

1. Ponzi Schemes

One of the most notorious types of investment scams in forex trading is the Ponzi scheme. In this scenario, the initial investors are paid returns from the capital of new investors, rather than from profit earned by the operation of a legitimate business. These schemes eventually collapse when the operators can no longer recruit enough new clients to pay existing ones. Unsuspecting individuals are often lured by promises of high returns with little risk.

2. Signal Seller Scams

Many traders rely on signals—predictions about future market movements—to guide their trading decisions. However, some individuals and companies falsely claim to provide expert signals for high profits. Many of these signal sellers are not legitimate traders; they might not even be using the strategies they advocate. Traders can end up losing money by following bad or fraudulent signals. Always conduct thorough research before trusting any signal service.

3. Fake Brokers

With the proliferation of online trading platforms, fake brokers have become a significant concern. These fraudulent platforms might offer enticing bonuses, leverage options, and easy signup processes. However, they often operate without the necessary regulatory oversight, and once you deposit funds, they either deny withdrawals or disappear entirely. Always ensure that any trading platform is regulated by a reputable financial authority.

4. Investment Opportunity Scams

Some scams are disguised as investment opportunities, where scammers promote exclusive forex trading programs claiming to yield extraordinary profits. They often use complex jargon to make their schemes sound legitimate. Victims are pressured to invest quickly with promises that the opportunity will not last. Legitimate investments should always allow potential investors adequate time to research and consider their options.

Signs of a Forex Trading Scam

Identifying a forex trading scam is vital for protecting your investments. Here are a few red flags to look out for:

- Unrealistic Promises: Promises of guaranteed returns, especially those claiming to be risk-free, should raise suspicion.

- Lack of Regulation: Verify if the broker is regulated by a recognized authority. Unregulated brokers often lack accountability.

- Poor Communication: If it’s challenging to reach customer service or if the communication is unprofessional, this could be a sign of a scam.

- High-Pressure Tactics: Be wary of anyone pressuring you to invest quickly or providing too much urgency.

- Minimal Information: Legitimate brokers provide detailed information about their services, trading conditions, and risks. Scammers often hide this information.

How to Protect Yourself

Now that you know what signs to look for, here are some proactive steps to protect yourself from forex trading scams:

1. Do Your Research

Before committing any funds, take the time to research the broker or trading platform. Look for reviews and testimonials and check their regulatory status. There are many reputable reviews available online that can provide insights into a broker’s legitimacy.

2. Utilize Trusted Sources

Use resources such as financial news outlets and regulatory bodies to verify the legitimacy of brokers and their offers. Also, consider using established trading platforms with a solid reputation.

3. Start with a Demo Account

Many reputable brokers offer demo accounts, allowing you to practice trading without risking your real money. Use a demo account to test the platform and understand trading without the pressure of financial loss.

4. Be Wary of Unsolicited Offers

If someone claims to have a “winning strategy” and reaches out to you unsolicited, be cautious. Scammers often use cold calling or unsolicited emails to lure their victims.

Conclusion

Forex trading can be lucrative, but it’s also fraught with risks, particularly from scams. By educating yourself about the different types of forex trading scams and knowing the warning signs, you can better protect your investments. Always prioritize due diligence, research your options thoroughly, and choose reliable trading platforms. Your financial security is paramount, and with awareness and caution, you can navigate the forex market successfully.