Engaging in Forex trading requires more than just knowledge; it demands practice. Whether you are a novice looking to dip your toes into the world of currency trading or an experienced trader aiming to refine your strategies, engaging in simulated Forex trading can significantly boost your skills. To make the most out of your trading practice, many traders choose to work with reliable platforms like forex trading practice Qatar Brokers. This article will guide you through various effective Forex trading practices that can help improve your techniques and understanding of the market.

Understanding the Basics of Forex Trading

Before diving into practice, it’s essential to grasp the foundational concepts of Forex trading. Foreign exchange (Forex) is the global market where currencies are bought, sold, and exchanged. With a daily trading volume exceeding $6 trillion, Forex is the most liquid market in the world. Traders engage with this market to profit from the fluctuations in currency prices.

The primary participants in Forex trading include central banks, financial institutions, corporations, and individual traders. Each plays a unique role in determining currency values, influenced by economic indicators, geopolitical events, and market sentiment.

The Importance of Forex Trading Practice

To excel in trading, practice is key. A well-planned practice can enhance your trading abilities, build your confidence, and reduce emotional decision-making. Here are some reasons why practicing Forex trading is important:

- Skill Development: Practicing allows you to test and refine your trading strategies without the risk of losing real money.

- Understanding Market Dynamics: Regular trading practice helps you understand the dynamics of price movements and the factors that affect currency values.

- Emotional Resilience: Frequent practice helps you manage the emotions associated with trading, such as fear and greed, enabling you to trade more rationally.

- Strategy Testing: You can test new strategies in a controlled environment, allowing for adjustments and improvements before applying them in live trading.

Tools for Forex Trading Practice

To enhance your Forex trading practice, utilizing the right tools is crucial. Here are some key tools that can help:

- Demo Accounts: Most reputable brokers offer demo accounts that allow you to trade with virtual money. This is an invaluable resource for practicing trading strategies in real market conditions.

- Trading Software: Various trading platforms like MetaTrader offer advanced charting tools, indicators, and automated trading capabilities to assist in practice.

- Forex Simulators: Trading simulators provide a realistic trading environment where you can practice without financial risk. These simulators replicate market conditions and can be instrumental in building your skills.

- Educational Resources: Utilize webinars, e-books, and online courses to enhance your knowledge of trading strategies and market analysis.

Effective Practices for Forex Trading

Here are several effective practices that can significantly improve your Forex trading skills:

1. Develop a Trading Plan

A trading plan outlines your trading goals, risk tolerance, and strategies for entering and exiting trades. This structured approach minimizes impulsive decisions and keeps you focused on your objectives.

2. Use Technical Analysis

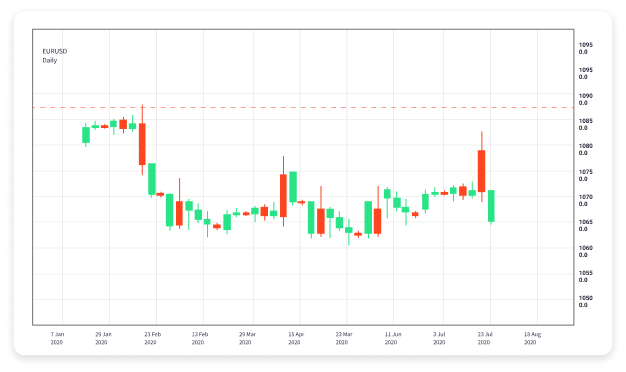

Technical analysis involves analyzing historical price charts and patterns to forecast future price movements. Learning how to read charts and identify trends is crucial for making informed trading decisions.

3. Keep a Trading Journal

Maintain a journal documenting your trades, including entry and exit points, strategies used, and the outcomes. Analyzing your past trades will help you learn from mistakes and identify what works best for you.

4. Manage Risk Effectively

Sound risk management is vital in Forex trading. Always set stop-loss and take-profit orders to protect your investments. Only risk a small percentage of your trading capital on each trade to minimize potential losses.

5. Stay Informed

Keeping up with the latest news and economic indicators affecting currency markets will give you a competitive edge. Economic calendars can help you track important events that might impact currency prices.

Psychology of Trading

Emotions heavily influence trading performance. Understanding the psychology behind trading is crucial for success. The common emotions experienced by traders include:

- Fear: Fear of losing can lead to missed opportunities or premature exits from winning trades.

- Greed: Overconfidence can lead to taking excessive risks or holding onto losing positions longer than necessary.

- Frustration: Losing streaks can lead to emotional trading decisions that deviate from your trading plan.

Developing emotional resilience through practice will help you maintain discipline, especially in challenging market conditions.

Conclusion

Forex trading practice is an essential component of becoming a successful trader. By developing a robust trading plan, utilizing the right tools, and maintaining discipline, you can significantly enhance your trading skills. Remember that practice is a continuous journey, and blending theoretical knowledge with practical experience is the key to mastering Forex trading.

Start your journey today, and with dedication and perseverance, you will improve your trading techniques and achieve your financial goals in the Forex market.